ESG AI Launches ESG Risk Platform to Power Banks & Insurers with Instant ESG Risk Visibility on Any Business, Anywhere

ESG AI launches global platform enabling banks, insurers & credit bureaus to assess ESG risks instantly across any business, industry, or country.

SYDNEY, AUSTRALIA, May 22, 2025 /EINPresswire.com/ -- ESG Artificial Intelligence (www.esgartificialintelligence.com) has today announced the expansion of its global ESG risk intelligence platform, designed specifically to meet the fast-evolving needs of insurance companies, financial institutions, and credit rating agencies. With a simple $500/year subscription model and coverage for any business in any country, ESG AI provides rapid, scalable ESG risk assessments in 2 minutes, transforming how financial institutions manage ESG risk across clients, suppliers, portfolios, and underwriting operations.

A Game-Changer for ESG Risk Assessment at Scale

As regulatory expectations escalate globally, via frameworks such as IFRS S2, CSRD, SFDR, ISSB, and climate disclosure laws in jurisdictions from Europe to Southeast Asia, financial institutions face a critical need to evaluate ESG risk consistently across large and diverse business networks.

ESG AI responds to this challenge with a fully automated, cloud-based platform that enables insurers, banks, and credit bureaus to:

• Assess any business in any sector or country across 42 ESG criteria, including carbon emissions, labor rights, biodiversity, corruption risk, and modern slavery.

• Instantly identify red flags and supply chain vulnerabilities, benchmark against peers, and align assessments to regulatory and internal frameworks.

• Lower the cost of ESG due diligence, bringing assessments down to less than $100 per business assessed (and monitored for a year).

“The ESG risk landscape is too complex and too fast-moving for traditional models to keep up,” said James Cronan, Founder & CEO of ESG AI. “Banks, insurers, and rating agencies need fast, affordable ESG insights—not in six months, but in minutes. ESG AI makes that possible.”

A Strategic Solution for Financial Risk and Regulatory Readiness

For Insurance Companies:

• ESG AI supports underwriting accuracy and claims reduction by identifying environmental, social, and governance risks that can compromise business continuity.

• With over 60% of insurers now prioritizing ESG data in underwriting (PwC), ESG AI allows firms to model risk and offer differentiated ESG-linked insurance products.

• Insurers using ESG AI have seen underwriting precision improve by up to 25% and claim ratios drop by 15%, according to industry benchmarks.

For Banks and Credit Bureaus:

• ESG AI integrates into lending decisions, client onboarding, and credit scoring, providing a 360° view of ESG-related credit risk.

• Banks can comply with ESG-linked lending obligations, enhance due diligence for ESG financing products, and support clients on their ESG maturity journey.

• Credit bureaus and risk agencies use ESG Artificial Intelligence to strengthen risk ratings with ESG intelligence that reflects a company’s true sustainability exposure.

Key Platform Capabilities:

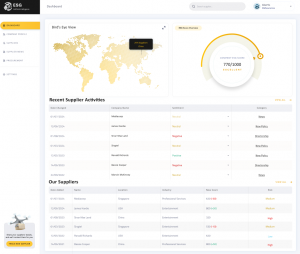

• AI-Driven ESG Risk Assessments: Evaluate companies in real time using natural language processing, industry benchmarking, and public/private data sources.

• Global Compliance Mapping: Reports align with major global ESG frameworks, and national sustainability mandates picking up both national and global legislation.

• Supplier and Portfolio Risk Scanning: Upload and scan thousands of companies via API or bulk import to identify high-risk entities instantly.

• Custom Dashboards for Financial Institutions: White-label options available for banks and insurers to offer ESG insights directly to clients and underwriting teams.

“We’re not just helping institutions comply with ESG regulation—we’re helping them lead in ESG innovation,” added Cronan. “Whether you're an insurer refining your risk model, or a bank launching a sustainability-linked loan product, ESG AI gives you the intelligence to move fast and lead responsibly.”

Why It Matters

• Only 8% of SMEs currently report on sustainability, leaving massive visibility gaps for underwriters and lenders.

• Over 60% of financial institutions now consider ESG data essential for risk and investment decisions (Deloitte).

• Yet fewer than half of insurers have embedded ESG data into their workflows—creating an urgent opportunity for tech-driven change (Capgemini).

About ESG AI

ESG Artificial Intelligence Pty Ltd is a global technology company building affordable, AI-powered ESG intelligence tools for businesses, financial institutions, and governments. Its platform helps organizations quickly assess ESG risks, comply with disclosure requirements, and make informed decisions that drive sustainability, risk resilience, and competitive advantage.

James Cronan

ESG Reporting Intelligence

+61 407 667 658

email us here

Visit us on social media:

LinkedIn

Distribution channels: Banking, Finance & Investment Industry, Business & Economy, Insurance Industry, International Organizations, Technology

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release